Strategist Predicts 10%-15% Jump in Stock Market in Coming Months: Easy Outlook

NEW YORK — Tom Lee, a top Wall Street strategist from Fundstrat Global Advisors, predicts a 10%-15% jump in the stock market over the next few months, as of March 14, 2025.

Speaking from New York, Lee shared his bold call this week, citing key trading days and economic shifts as the reasons. He aims to calm investors after a rocky start to the year and point to a bright rebound ahead.

A Fresh Take After a Rough Patch

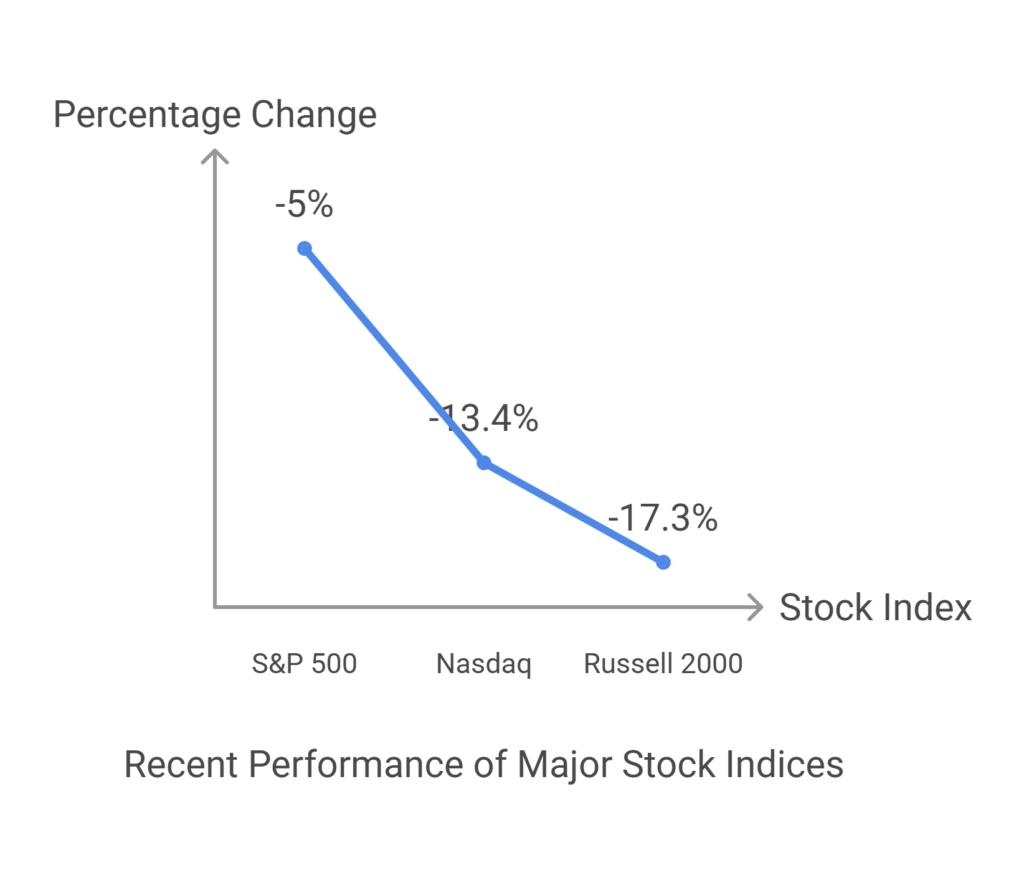

Lee’s forecast comes at a tense time. The S&P 500 has dropped 5% since January, erasing gains from Trump’s election win last fall. Investors are jittery — tariffs, inflation fears, and a shaky jobs report have fueled sell-offs. On March 10, the index teetered near a correction, down almost 10% from its December peak. Tech stocks, like those in the Nasdaq, fell 13.4%. Smaller companies in the Russell 2000 sank 17.3%.

But Lee sees light ahead. “I think it’s very possible that March, April, May could actually be one of these huge rally months where we’re rallying 10-15%,” he told Fortune in an interview. He’s not guessing blindly. Lee nailed the market’s big runs in 2023 and 2024, when the S&P 500 soared over 20% each year. Now, he’s betting on a bounce, driven by just a handful of strong days.

Why the Optimism?

History backs him up. Lee points out that most yearly stock gains come from 10 top trading days. In 2024, those days added 20 points to the S&P 500’s climb. Miss them, and gains shrink to 4%. He thinks those big days are near. Economic data could spark them — a solid jobs report or cooling inflation might flip the mood.

Trump and the Fed Factor

There’s more to it. Lee mentions a “Trump put” or “Fed put.” That’s jargon for a safety net. If the economy wobbles, President Trump or the Federal Reserve might step in. Trump’s paused some tariffs on Canada and Mexico, though he’s hiked them on China to 20%. The Fed could cut rates if growth slows. Markets love that kind of cushion. On March 11, Fed Chair Jerome Powell hinted at steady support, lifting stocks a bit.

A Rocky Road Behind

Context matters here. The market’s been wild. After Trump’s win, the S&P 500 jumped 2.5% in a day. Then came tariff talk and uncertainty. By March 4, that post-election glow was gone. Tech giants like Nvidia and Tesla, stars of past rallies, stumbled. Small stocks took a harder hit. “Uncertainty is driving the sell-off,” said Rob Haworth, a strategist at U.S. Bank, earlier this week. Lee argues the worst is priced in.

What’s Fueling the Rally?

Lee’s not alone in spotting hope. The S&P 500’s forward price-to-earnings ratio sits at 21.2, above its 10-year average of 18.3. That’s high, but earnings could catch up. Analysts expect 15.7% profit growth in Q4 2025. If companies deliver, stocks could soar. Plus, sectors like financials and industrials might lead, not just tech. A broader rally could lift all boats.

Investors aren’t all in yet. Some on X call it “wishful thinking” after recent dips. Others cheer Lee’s track record. His 2023 and 2024 calls were spot-on — he pegged the S&P 500 at 5,500, then 6,000. It closed 2024 at 5,900. Now, he’s eyeing 6,500 or higher by May. That’s a leap from today’s 5,600-ish level. But he warns: timing’s tricky. Missing those 10 days could tank returns.

Risks on the Radar

Not everything’s rosy. Tariffs could bite harder — 20% on Chinese goods might spike costs. Jobs data’s mixed. February added 151,000 jobs, in line with hopes, but cuts elsewhere loom large. Inflation’s at 2.4%, down from 8% in 2022, yet a second wave could hit, says a Strategas study. If the Fed hikes rates instead of cuts, Lee’s rally might stall. “The environment is fragile,” admits Anthony Termini, an analyst at Annuity.org.

Still, Lee’s unfazed. He thinks markets have already swallowed the bad news. Falling real interest rates — yields minus inflation — signal a dip in fear. The VIX, or “fear index,” spiked to a six-month high but eased this week. That’s a green light for bulls, he says.

What’s Next for Investors?

This prediction could shake up plans. If Lee’s right, stocks jump to 6,160-6,440 by May. That’s big for retirement funds or traders. Investors might hold tight, not sell, to catch those 10 days. Young savers could stay diversified. Retirees might trim risky bets, says analyst Scott Ward. Either way, it’s a call to watch close — and act fast if signals align.

The market’s at a crossroads. A rally could cement 2025 as another win. A flop might mean bargains later. Lee’s bet hinges on data and policy, not just hope. Will it pan out? The next few months will tell. For now, his voice cuts through the noise, offering a lifeline to rattled investors.