Automotive Component Production in India to Reach Over $145 Billion by 2030: NITI Aayog

NEW DELHI — Production of automotive components in India could surge to $145 billion (around 21.64 lakh crore) by 2030, with exports tripling in the process to stand at $60 billion by the same year, a report from NITI Aayog noted on April 11, 2025.

The report, launched by Vice Chairman Suman Bery, titled “Automotive Industry: Powering India’s Participation in Global Value Chains,” proposes a “bold” vision to increase India’s global market share from 3% to 8%. The move is seen as intended to catapult India to the forefront of an auto revolution with global implications as demand for electric vehicles and advanced manufacturing grow.

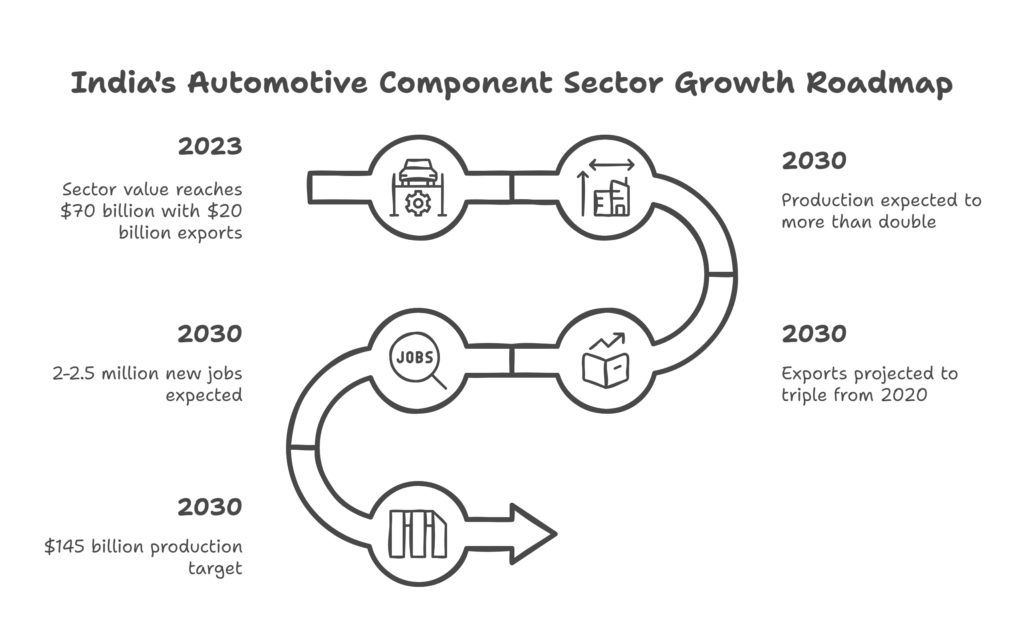

A Roadmap for Growth

The NITI Aayog report provides a roadmap for India’s automotive component sector. In 2023, sector value reached $70 billion with exports of $20 billion. Production is expected to more than double by 2030, fueled by demand for high-quality parts and government backing. Exports are expected to soar to three times their 2020 level, producing a $25 billion trade surplus. The report notes India’s strengths, including its cost-competitive work force and the “Make in India” program that has helped propel India to become the fourth largest vehicle producer in the world, after China, the U.S. and Japan.

India’s car industry directly employs around 1.5 million people. This boom could create 2-2.5 million new jobs, for total employment of 3-4 million by 2030. “This report envisages India reaching $145 billion of production of automotive components in 2030, a target that is ambitious and attainable if the right policies are adopted,” said NITI Aayog Vice Chairman Suman Bery, at the launch. The report highlights electric vehicles (EVs) and Industry 4.0 technologies, such as AI and robotics, as major catalysts for this growth.

Challenges to Overcome

While it has immense potential, the Indian automotive component industry has its challenges. The country accounts for only 3% of the global $2 trillion auto parts market, with exports totalling $20 billion versus $700 billion globally. High-precision segments such as engine parts and transmissions continue to be a weak point, with India holding only 2-4% market share. Progress is hindered by operational costs, infrastructure gaps and a lack of research and development (R&D) spending. According to the report, India is 10% more expensive than China, which means that in some subsectors India is not competitive at all.

The NITI Aayog recommends fiscal and non-fiscal measures to address these issues. Fiscal incentives cover operational costs as well as support for skill development and R&D. Non-fiscal measures include embracing smart factory technologies, reducing the number of regulations, and establishing global partnerships. Another priority to reduce logistics costs is cluster development, in which firms share facilities such as testing centers. Free trade agreements with other markets — particularly the U.S. and the EU — could also increase exports, allowing India to compete in value-added segments.

Global and Domestic Context

Once again, India’s automotive sector stands at a tipping point. The global transition to EVs, driven by consumer demand and tougher emissions rules, creates opportunities. The world made 94 million vehicles in 2023, and from India came almost 6 million of those. The growth of EVs has sparked a higher demand for batteries and electronic components, both sectors where India aspires to build scale. Domestically, initiatives such as the Production-Linked Incentive (PLI) programme and FAME-II to incite investment in EV manufacturing are in place.

Still, challenges remain. Vehicle demand in rural areas is patchy, while high input costs might temper growth. The report emphasizes that the infrastructure — roads and ports — to support exports will need improvement. Training programs are also key in readying workers for advanced manufacturing. Addressing these gaps will enable India not only to deliver on its domestic needs, but to also evolve as a global supplier for auto parts players, particularly for emerging segments like electric vehicles and small vehicles, where India is already a success story.

What Lies Ahead

The target of $145 billion in auto-component manufacturing marks an ambitious stride for the Indian economy. Success could transform the sector, creating jobs and exports, and cementing India’s place in global supply chains. But making this vision a reality will require fast action. Policymakers need to provide incentives, develop infrastructure, and nurture innovation in order to catch up with competitors such as China. Players across the industry will have to put in capital in technology and skills to cater to rising demand for EVs and precision parts.

The next several years will be critical. If India can get past its challenges, the automotive sector might steer wider economic growth to the buoyancy of millions of livelihoods. Doing nothing, however, threatens to miss an important opportunity in an increasingly competitive global market. For now, this is all we have in form of a rough draft — the NITI Aayog report provides a cogent blueprint — but making this vision a reality would require a concerted effort by the government, industry and workers.