Simple Scoop on X Acquired by xAI

SAN FRANCISCO — Elon Musk’s artificial intelligence company, xAI, acquired his social media platform, X, for $33 billion on March 28, 2025.

The all-stock deal, announced via a post on X, happened in San Francisco. It blends xAI’s AI smarts with X’s huge reach. Why? Musk wants to boost both companies and speed up AI growth.

How It All Went Down

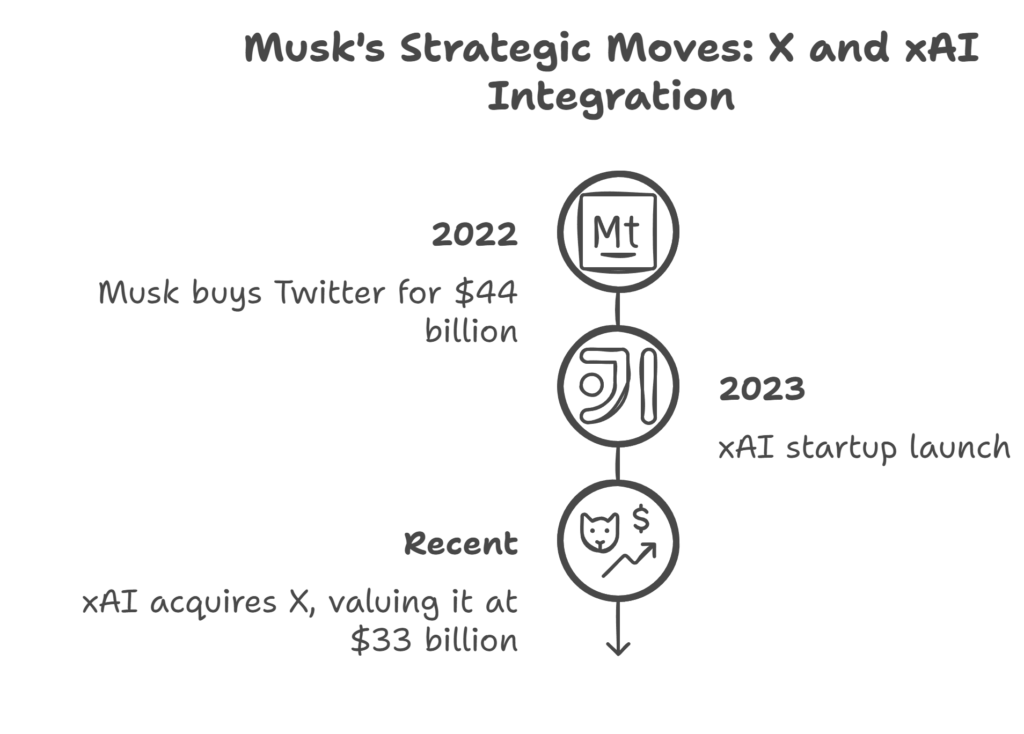

Musk’s been busy. He bought X—then called Twitter—for $44 billion in 2022. It was a wild ride—staff cuts, policy shifts, and a name change followed. Now, xAI, his AI startup from 2023, snapped it up. The deal values xAI at $80 billion and X at $33 billion, after accounting for $12 billion in debt. It’s a big move to tie the two closer together.

X has over 600 million users, Musk says. That’s a goldmine of data for xAI’s chatbot, Grok, which already lives on X. The acquisition happened fast—talks started months ago, but Friday’s post sealed it. Posts on X buzzed with reactions, some calling it “Musk magic.” Others wondered about the money math, since X’s value dipped before.

Why This Matters

This isn’t just a business swap. Musk’s blending his empire—think Tesla, SpaceX, and now xAI with X. He’s chasing AI dominance, rivaling OpenAI, a company he once co-founded. X’s data could supercharge xAI’s models, making Grok sharper. “This will unlock immense potential,” Musk wrote on X, promising smarter experiences for users.

The deal’s timing is key. X struggled after Musk’s 2022 buyout—ads fled, value tanked to $12 billion at one point. But lately, it’s bounced back. Trump’s 2025 return to power, with Musk advising, helped. Brands returned to X, betting on its sway. The $33 billion tag shows faith in its future, even if it’s less than the $44 billion Musk paid.

Behind the Numbers

The all-stock deal means no cash changed hands—just shares. X investors now own part of xAI. Both firms are private, so details are slim. Morgan Stanley handled it, advising both sides. Some X backers, like Sequoia Capital, already had stakes in xAI. The setup cuts red tape—Musk controls both, so it’s his call.

xAI’s rise adds context. Launched to “understand the universe,” it’s grown fast. A $10 billion funding round last year pegged it at $75 billion. Now, with X, it’s valued at $80 billion. X’s $12 billion debt stays, but the merger might ease that load. Analysts say it’s a bet on AI eating social media’s lunch.

What’s Next for X and xAI?

This could shake things up. X might morph into an AI-driven hub—think Grok answering posts or shaping feeds. Users could see slicker features soon. For xAI, X’s data is rocket fuel—training AI faster than rivals. Musk’s hinted at more: “This is just the beginning,” he posted.

Risks loom, though. X’s ad cash isn’t guaranteed—past flops hurt. If xAI leans too hard on X data, privacy gripes could flare. Regulators might peek, but Musk’s private firms dodge most scrutiny. The big question? Can he juggle Tesla, SpaceX, and this new beast? Investors and fans are watching.

The deal’s a Musk classic—bold, fast, and a little wild. X users might get a front-row seat to AI’s next leap. Or it could stumble. Either way, it’s a story to track. Check X for updates—it’s where Musk spills the tea.