Retail Inflation in March Unchanged at 3.60% After Four-Month Drop

NEW DELHI — India’s inflation rate based on the Consumer Price Index (CPI) was unchanged at 3.60% in March 2025, bringing to an end a four-month decline, government data released by the National Statistical Office showed on April 15.

The figure, the same as February’s 3.61%, is due to stable consumer prices, despite being influenced by erratic rainfall and higher gold prices. The policy stability comes as the Reserve Bank of India (RBI) keeps a watch on economic growth in the context of global uncertainties.

Why Inflation Stayed Flat

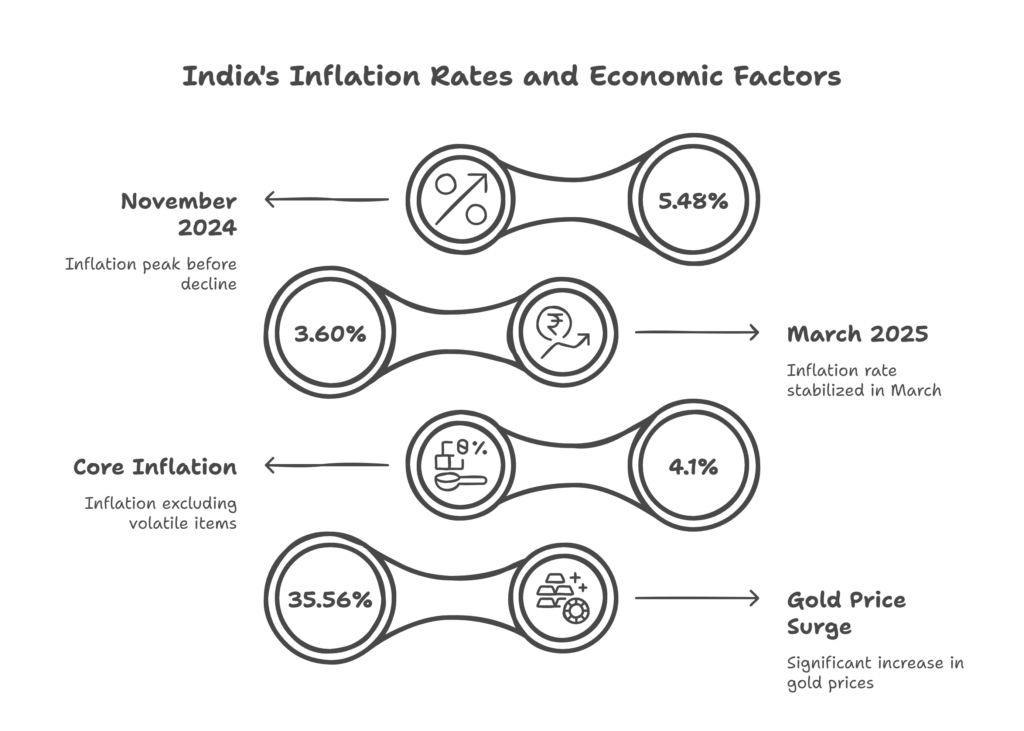

India’s inflation rate remained unchanged at 3.60% in March, halting a phase of declining figures that started in November 2024, when inflation was at 5.48%. Economists cite other factors as well, including a balance between increasing prices for gold and flat food costs. A poll of 40 economists by Reuters, taken April 3-8, had expected just such an turn of events, given that food prices — which comprise almost half of the CPI basket — probably troughed in March. An uneven monsoon and heat waves hurt farm output, preventing vegetable and fruit prices from stabilizing and falling further.

Gold prices, on the other hand, surged in February, rising 35.56%, according to a Mint Analysis. This more than made up for the absence of any big food price rises. Core inflation, which strips out volatile food and energy prices, ticked up to 4.1 percent from an estimated 3.9 percent in February. Monsoon had helped Settle well within the RBI’s target range of 2-6%, allowing hands on growth for policymakers. “In the environment where inflation remains within our target level, this is a good sign that will enable us to focus on recovery of the economy,” Governor Shaktikanta Das said in a statement April 9.

Overall Economic Context and Challenges

The stable inflation rate comes as India’s economy sends mixed signals. The RBI reduced its projection for GDP growth in 2025-26 to 6.5% and from 6.7%, as global trade tensions, including U.S. tariffs weighed on growth. Industrial production increased 5 percent in January, led by manufacturing and mining, but consumer spending remains patchy. Food inflation, a key concern for families, fell to 3.75% in February, its lowest in almost two years, providing respite for millions.

Data from March, however, suggests some challenges ahead. Prices of vegetables and fruits are likely to increase seasonally as the summer heat rises, which may keep inflation elevated. Wholesale price inflation similarly edged up to 2.50% in March from 2.38% in February, suggesting widespread price pressures. The repo rate was reduced to help growth, the RBI’s Monetary Policy Committee said April 9 when it cut it by 25 basis points, a move linked by analysts to inflation remaining below the 4 percent midpoint goal.

Regional and Global Factors

Inflation is uneven within India’s states. Kerala recorded the highest during this month at 7.3%, while it was only at 1.3% in Telangana. Rural areas are still experiencing higher inflation than urban centers, a phenomenon largely driven by its deeper weight on food in rural budgets (54.2% versus 36.3%). But India still compares favorably on the global stage, as inflation in the U.S. rises alongside the threat of tariffs reversing a slide in prices. India’s central bank, though, is taking a cautious approach, balancing domestic demands with external threats like a weaker rupee and more expensive imports.

The services sector, which is an important component of the economy, was the weakest in March, with the HSBC India Services PMI slipping to 58.5 against 59.0. Declining demand and higher input cost also can exert pressure over the coming months. Still, the stability of inflation provides a window for policy adjustments, and economists predict a third rate cut in August if trends continue.

What’s Ahead for India’s Economy

It is also welcome news for the RBI and policymakers, as inflation in India was steady at 3.60%. Now that inflation is well within the target range, attention turns to stimulating growth, particularly in rural areas where consumption is weaker. A recent rate cut from the central bank, which seeks to result in more affordable borrowing and prompt consumer spending and investment. But there are looming risks like seasonal price increases and disruptions to global trade.

Analysts say March data may be the turning point. If food costs rise as projected, inflation might approach 4% by mid-2025. The RBI’s forecasts hold CPI inflation at 3.6% in the first quarter, climbing to 4.4% by year’s end. Policymakers are expected to continue to closely monitor monsoon patterns and global prices of commodities that have a heavy countryspecific impact. Stability does provide a measure of cautious optimism but vigilance over domestic and global challenges is vital as India takes a few more steps.