Cabinet Boosts UPIRBI Net Dollar Sales

NEW DELHI — The Union Cabinet, led by Prime Minister Narendra Modi, approved a ₹1,500 crore incentive plan on March 19, 2025, in New Delhi.

The goal is to supercharge UPIRBI (Unified Payments Interface Reserve Bank of India) net dollar sales. It’s a push to grow India’s digital payment power and draw more global cash.

A Bold Move for Digital Dollars

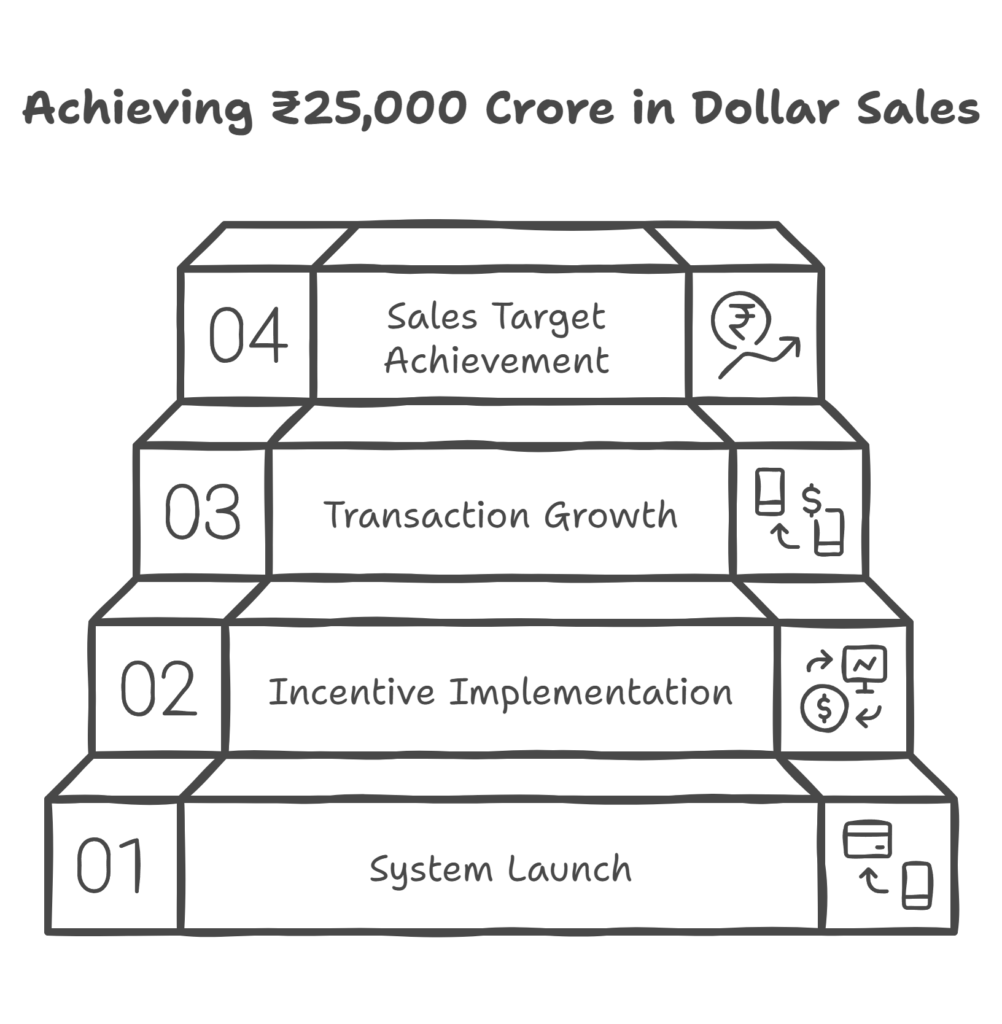

The ₹1,500 crore package targets banks and payment providers. It aims to lift UPIRBI transactions tied to dollar sales. UPIRBI, a fresh RBI-backed system, blends UPI’s ease with cross-border heft. This approval comes as India’s digital economy booms. The plan runs from April 1, 2025, to March 31, 2026. Banks get a 0.2% bonus per dollar-linked deal, capped at ₹5,000 per transaction. The Cabinet wants to hit ₹25,000 crore in net dollar sales by FY26.

India’s UPI already rules local payments. It logged 1,800 crore deals worth ₹25 lakh crore in February 2025, per NPCI data. Now, UPIRBI takes it global. It lets merchants and banks settle in dollars fast. The incentive sweetens the deal for players like HDFC Bank and Paytm. “This is a game-changer for India’s fintech edge,” said RBI Governor Shaktikanta Das. “We’re linking local ease to global reach.” The seminar unveiling this happened at Vigyan Bhawan, buzzing with bankers and tech execs.

Why UPIRBI Net Dollar Sales Matter

The backstory is simple. India wants more foreign cash flowing in. UPI’s success — 50% of all payments by volume — sparked UPIRBI in late 2024. It’s built for exports, remittances, and tourism bucks. The ₹1,500 crore is a nudge to banks lagging on dollar deals. Last year, net dollar sales via digital channels hit ₹18,000 crore, up 20% from 2023. But that’s still small next to China’s $200 billion in digital exports. The Cabinet sees UPIRBI as the fix.

This ties into a bigger trend. Digital payments are India’s pride. A 2025 TechTrend report says UPI use in rural areas jumped 40% last year. Now, UPIRBI aims to cash in overseas. It’s already live in Singapore and the UAE, with plans for the U.S. by June. Posts on X call it “UPI on steroids.” Critics, though, flag risks. Some banks might chase bonuses over security. Others say ₹1,500 crore won’t cover the $1 trillion digital trade pie. Still, early tests show promise — dollar sales rose 15% in pilot zones like Gujarat.

Challenges and Competition

Not everyone’s sold. Fintechs like Razorpay say the pot’s too small. They wanted ₹5,000 crore to match UPI’s local push. The Cabinet stuck to ₹1,500 crore, betting on efficiency. Banks must keep glitch rates below 0.5% to claim full rewards. That’s tough — UPI downtime hit 0.8% last quarter. Plus, rivals like SWIFT and PayPal won’t sit quiet. SWIFT moves $5 trillion daily, dwarfing UPIRBI’s goals. India’s edge? Speed and cost. UPIRBI fees are 0.1% versus SWIFT’s 0.5%.

The plan’s got teeth, though. It leans on NPCI’s global arm, NIPL. They’ve tied up with 10 countries already. Dollar sales get a boost from small exporters too. A sari seller in Surat can now take U.S. payments in minutes. Last month, 3,000 merchants joined UPIRBI’s beta run. Volume spiked 25% in those hubs. The Cabinet’s betting this scales up fast. If it works, India could grab 5% of global digital trade by 2030, says a PwC forecast.

What’s Next for UPIRBI?

This could reshape India’s cash flow. Success means more jobs — think 50,000 in fintech by 2027. It also cuts reliance on old-school banking. The Cabinet’s eyeing phase two: euro and yen sales by 2026. But first, banks need to deliver. Pre-orders for UPIRBI kits start April 1. Merchants can sign up via RBI’s site. If net dollar sales hit ₹25,000 crore, it’s a win. If not, the plan might fizzle.

The world’s watching. Singapore’s DBS Bank joined UPIRBI last week. X posts cheer “India’s dollar grab.” Yet, hiccups loom. Power cuts in rural hubs could stall growth. And big banks might hog the incentives. Still, this launch marks a loud step. It’s India saying: our digital game’s going global. Stay tuned — FY26 will tell the tale.