Stocks to Watch: Axis Bank, Tech Mahindra Shine on April 24

MUMBAI, Bharat, April 24, 2025 — Axis Bank, Tech Mahindra, Reliance, and Maruti Suzuki are among the stocks to watch right now because of their strong net income and store movements.

Announced in Mumbai, the above stocks are concentrated due to the strong quarterly results and industry trends driving India’s stock market. Investors watch the above stocks for potential additions as the Nifty 50 climbs above 24,300, a sign of a bullish phase.

Stocks to Watch: Earnings Spotlight

Axis Financial Institution, one of India’s major private lenders, reported a net net income of Rs. 7,117.5 crore for March 2025, beating the retail forecast. Its net curiosity revenue grew to Rs 13,811 crore, demonstrating steady increase. This makes Axis Bank a compulsory stock to watch, together with an analyst’s praise for its ability to manage loan costs. The second stock of the lender increased by 2 % in early trading, mirroring investor confidence in its increase.

Tech Mahindra, a major IT services firm, will be an alternative stock to watch next after a 76.5 percent annual increase in net net income close to 1,167 crore. Despite a 1.5 % fall in the changeless currency allowances, the business has a direct increase in cost margin. Tech Mahindra’s focus on AI and cloud support positions it as a stock to watch in the technology school sector, particularly as its spending extends worldwide.

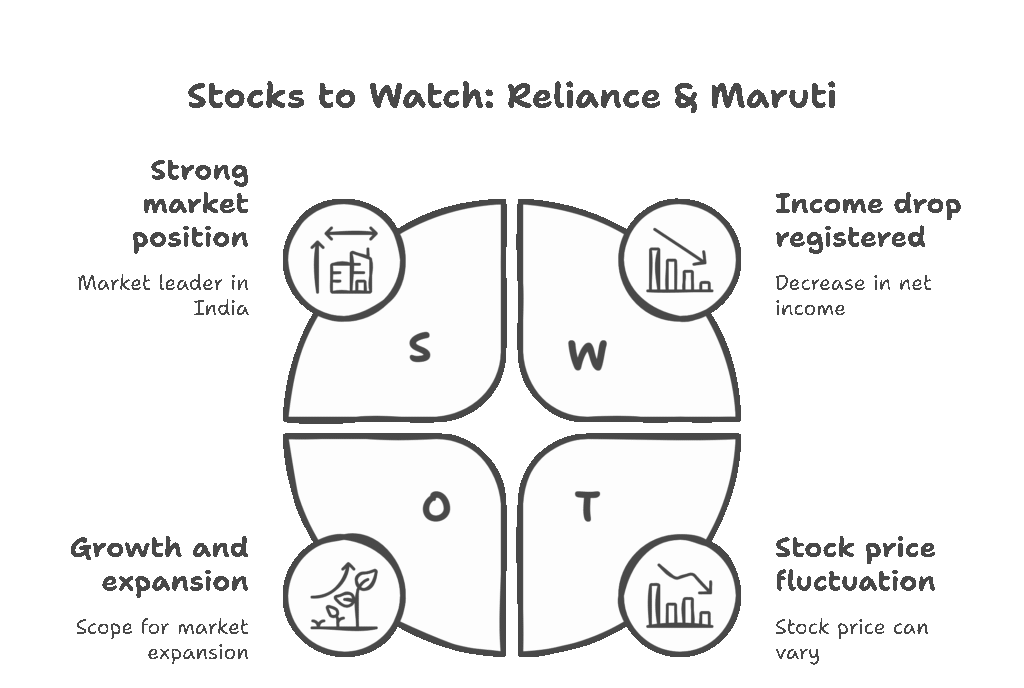

Reliance and Maruti Drive Markets

Reliance sectors, the Republic of India’s biggest business by exchange value, are a stock to watch as it prepares to announce its Q4 FY25 consequences these days. Reliance covers telecommunications, retail, and energy when the retail ceiling exceeds Rs 17.62 crore. Analysts expect strong growth in its vertical, creating a stock to monitor dividends and performance updates. Post X emphasizes investor Thrill, notes Reliance’s stock fluctuation between Rs 1,114.85 and Rs 1,608.80 over the past year.

Maruti Suzuki, India’s finest car manufacturer, will also be a stock to watch with its projected Q4 net earnings. Although Maruti’s tech-agnostic approach, including loanblend, EVs, and CNG, has remained aggressive in Q3 FY25, a 17 % drop in net income was registered in Q3 FY25 to Rs 3,069 crore. It is a stock to watch in the automobile sector, with a market share of 26% for SUVs. HSBC maintains a cost analysis and mentions its new launch plan for 2025.

Market Trends and Investor Strategies

India’s stock exchange will climb, with the Nifty 50 rising 12 percent in 2025. Stocks on the watch list Axis Financial Institution and Tech Mahindra benefit from the region’s recovery in financial management. Meanwhile, Reliance and Maruti Suzuki grew both in customer and industry. Priya Sharma, a retail analyst close to Motilal Oswal, says: ” These stocks to watch reflect India’s monetary strength.”. “Fundamentals and timing should be the focus of investors. ‘The Sensex, below 764.84 points to 79.036.59 on April 24, shows volatility and calls for caution. ‘.

Investors use tools such as MarketSmith, Republic of India, for stock tracking. One’s CAN SLIM methodology highlights Axis Financial Institution and Maruti Suzuki’s net income growth and technical dominance. The concentration of Technology Mahindra’s automated reasoning unit harmonises itself with the global movement, while Reliance’s diversified portfolio assures stability. Nevertheless, the above stocks may be affected by global risks, such as trade tensions, to keep an eye on. For retail investors who build up 40 percent of Bharat’s secondary market, diversification and limit of losses are key.

Challenges and Opportunities

Stockpiles to avoid obstacles including high evaluation and diplomatic challenges. However, Axis lender’s shares, which trade alongside a 31 % discount to ICICI Financial Institution, still have a value that reflects tight liquidity. The decline in turnover of Tech Mahindra raises concerns, but the surge in net income reassures investors. Reliance and Maruti Suzuki will have to cope with rising costs and a slowdown in international demand. But their powerful fundamentals make them stocks to watch for a long time.

As India’s economy grows close to 7% of GDP, there are many possibilities. These four advantages, derived from internal needs and policy support, are preferred to stocks under observation. The retail focus of Axis Bank, the technological breakthroughs of Tech Mahindra, Reliance’s second market laterality, and Maruti’s SUV manufacturing plant are the ones who skillfully. In order to remain on top, investors can make use of real-time statistics and platforms that appreciate the MarketSmith Republic of India to produce the stocks for the optimal choice for 2025.

Looking Ahead for Investors

In order to watch the preferred Axis lenders, Tech Mahindra, Reliance, and Maruti Suzuki, the focus on the stock exchanges is on Bharat’s dynamic retail business. Investor approaches in 2025 will be shaped by the trends in their net income and regional development. While volatility persists, those stocks to watch offer growth opportunities and an approach along with discipline. In order to maximise tax revenues, investors should monitor quarterly consequences, global trends, and technical indicators.

As India’s second market develops, stocks to watch will generate wealth. The standouts are Axis depository’s steady increase in financial services, Tech Mahindra’s technological innovation, Reliance’s strong points, and Maruti Suzuki’s car direction. In addition to 70,000 active users on MarketSmith Bharat platforms, retail investors have tools to succeed. In order to follow the above stocks in the calendar month ahead, informed and diversified residence will be essential.