Nissan’s New CEO Eyes Honda Tie-Up

YOKOHAMA, Japan — Nissan’s new CEO, Ivan Espinosa, said on March 26, 2025, that the company needs partners to survive.

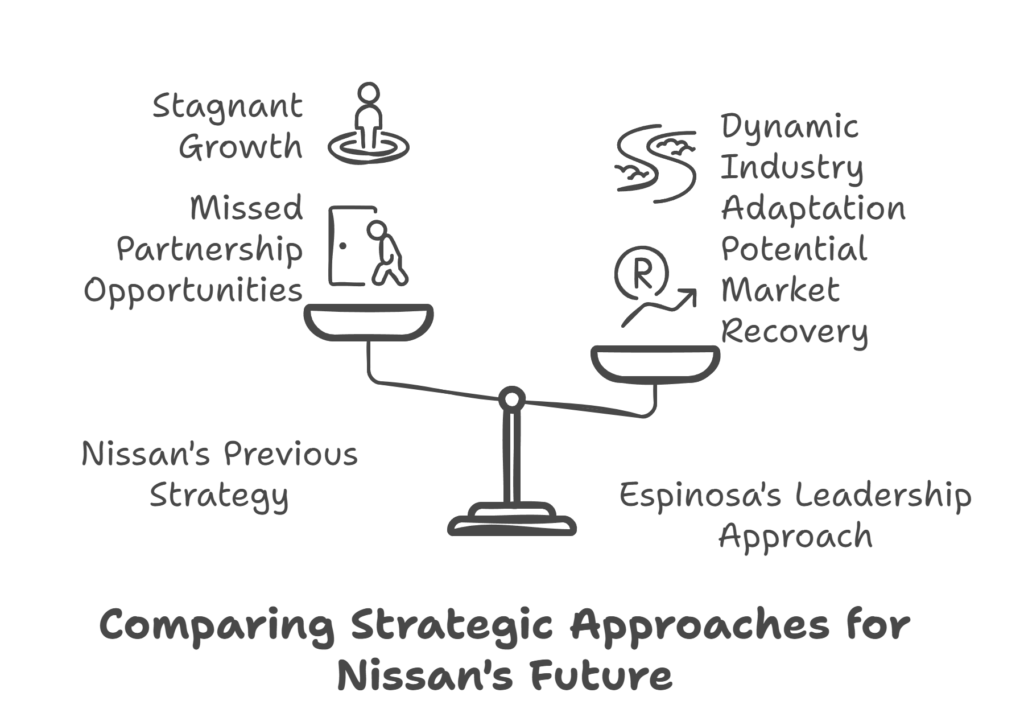

He’s open to working with Honda. This comes after merger talks with Honda failed last month. Espinosa takes over on April 1. Why? Nissan’s sales are dropping, and it needs help to grow.

A Fresh Start for Nissan

Espinosa, 46, steps in at a tough time. Nissan has warned of a third yearly loss in six years. Sales are weak in big markets like the U.S. and China. The old CEO, Makoto Uchida, couldn’t seal a deal with Honda. That merger would’ve made them the world’s third-biggest carmaker. Now, Espinosa wants to fix things fast. He’s a mechanical engineer who’s been with Nissan for over 20 years. His last job was chief planning officer.

“The auto industry’s changing,” Espinosa said at a press event in Atsugi, near Nissan’s base. “It’s going to need a lot of work and money. That means finding a partner.” He didn’t rule out Honda, even after their rocky past. Talks fell apart in February when Honda wanted Nissan as a subsidiary. Nissan said no, wanting equal footing. Still, Espinosa’s open to trying again.

Why Partners Matter

Nissan’s been struggling. Last November, it cut 9,000 jobs and slashed global output by 20%. The goal? Save cash and stop losses. But experts say that’s not enough. The car world’s racing toward electric vehicles (EVs) and smart tech. Nissan’s behind in both. Its Leaf EV was a pioneer, but rivals like Tesla and China’s BYD zoomed ahead. A partner could share costs and ideas.

Honda’s a natural fit. Both are Japanese and face the same threats. They signed a deal in March 2024 to explore EV and AI teamwork. That grew into merger talks by December. Adding Mitsubishi, where Nissan owns a big stake, could’ve boosted them to 8 million cars sold yearly. But Honda’s push for control ended it. Now, Espinosa’s “no-taboo” approach hints at fresh talks. He’s also eyeing tech firms like Foxconn, which wants Renault’s Nissan shares.

What’s Next for Nissan

Espinosa has big plans. He wants new cars out faster—30 months instead of 52. Nissan’s lineup is old, losing fans in key spots. In North America, a new Sentra sedan hits this year. The U.S. and Canada get an updated Leaf soon, with Tesla charger access. Europe sees the Micra EV return in 2025. India gets two new models by 2026. These moves aim to stop the financial slide.

But partnerships are key. “I’m open to Honda or others,” Espinosa said. “They just need to fit our vision.” Honda’s still talking with Nissan weekly, insiders say. They’re eyeing joint projects, like big SUVs. Nissan’s Pathfinder and Honda’s Pilot could share parts. That saves money and speeds things up. Other options? Foxconn or even private equity like KKR, which is sniffing around. Nissan’s got $6.7 billion in cash, but it’s burning through it fast.

The Road Ahead

What happens next could shape Nissan’s future. A Honda deal might rebuild trust and strength. Both could fight Tesla and Chinese brands better together. But if talks flop again, Nissan might turn elsewhere. Foxconn could bring tech know-how, though Japanese regulators might balk at its China ties. KKR could pump in money but not car-making skills.

Espinosa’s first days start April 1. He’ll need to pick a path quick. Nissan can’t go it alone, he admits. The industry’s too fast, too fierce. Fans and workers hope he pulls it off. A stronger Nissan could mean more jobs and cool cars. A weaker one might fade away. For now, all eyes are on Yokohama—and maybe Honda’s HQ too.