Tencent’s Teaming Up With Ubisoft Looks More Like a Takeover

PARIS — Tencent Holdings Ltd. acquired a €1.2 billion stake in Ubisoft Entertainment SA’s new subsidiary on March 27, 2025.

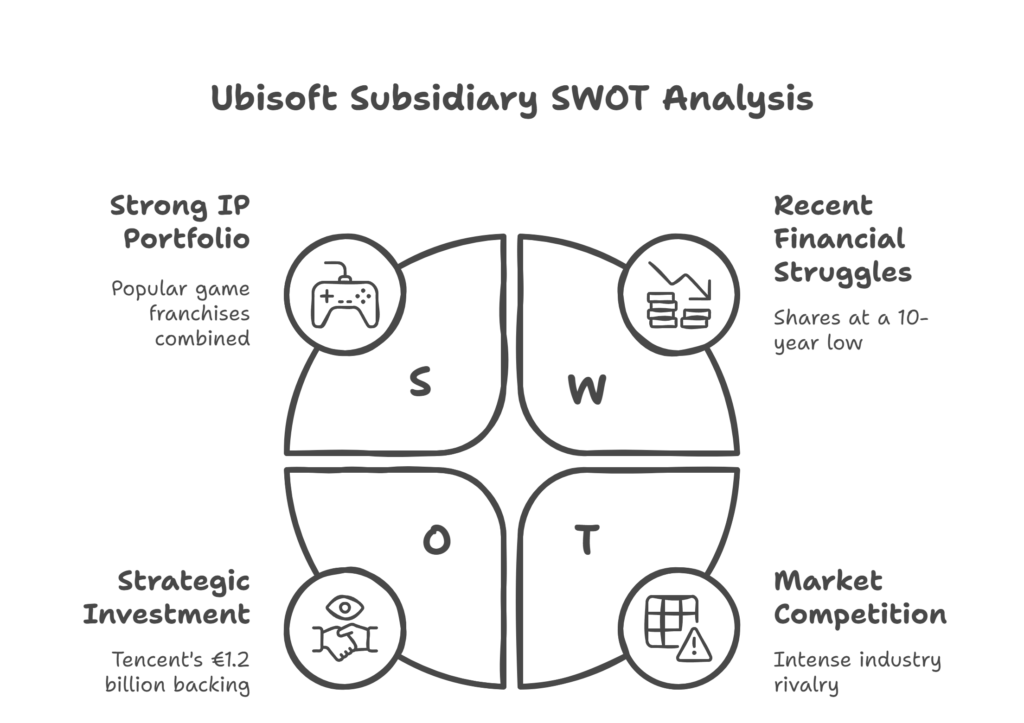

The deal, which was announced in France, will give the Chinese tech behemoth a 25% stake in a unit valued at €4.8 billion. It’s a daring stroke to pump up Ubisoft’s console heavy hitters and lock in Tencent’s grip on worldwide gaming.

A New Chapter for Ubisoft

This subsidiary was created by Ubisoft, the French video game maker, to focus on its biggest hits. Now, under one roof, have Assassin’s Creed, Far Cry and Tom Clancy’s Rainbow Six, to name a few. The €1.2 billion investment from Tencent — roughly $1.3 billion — values the new unit more than Ubisoft itself. The subsidiary will operate independently, but Ubisoft retains complete control.

The deal follows a rough patch for Ubisoft. Its shares fell to a 10-year low in 2024 after delays and weak sales. Assassin’s Creed Shadows, released in March 2025, did well commercially but didn’t entirely buoy the company. Tencent, which already held 10% of Ubisoft, saw an opportunity to strengthen its relationship. Ubisoft said it would use the cash to pay down debt and finance new projects.

How the Deal Works

The new unit will hold licenses for Ubisoft’s major franchises. In exchange, it sends royalty payments to the parent company. The subsidiary will absorb teams in Montreal, Barcelona, and Sofia. It’s meant to create “evergreen” game worlds — those that endure and evolve across platforms. Tencent takes a minority stake but no influence on day-to-day decisions.

“This makes us stronger for the future,” said Yves Guillemot, Ubisoft’s chief executive, in a statement. “With Tencent’s backing we can pursue major brands and new concepts.” The deal is expected to close late in 2025, subject to approvals. Ubisoft shares traded on Wall Street surged 18% once the word was out, to $45.60 midday March 27. That is a bright spot after years of struggle.

Tencent’s role isn’t new. Last year, it acquired a 49.9 percent stake in Guillemot Brothers Ltd., the family company linked to Ubisoft’s founders. French law limits foreign ownership to 30% without a bid, so Tencent remains a partner, not a boss. That arrangement preserves Ubisoft’s independence while harnessing Tencent’s deep pockets and China market expertise.

Why It Matters Now

Gaming is shifting fast. Games as a service — players want living, breathing titles, not one-off affairs. Ubisoft’s new unit wants to provide that. Demand was proven by Assassin’s Creed Shadows hitting 3 million players in weeks. But failures like Star Wars Outlaws and XDefiant are costing Ubisoft money. Tencent’s cash might prove to be the lifeblood to turn things around.

The timing aligns with broader trends. Tencent meandered into gaming, and China increased scrutiny of the sector. It already has stakes in Epic Games and Riot Games. Ubisoft, on the other hand, was the subject of buyout rumors in 2024. Some shareholders urged a Tencent takeover. This deal does just that, leavingthe Guillemot family in charge.

Risks linger, though. Now it’s up to Ubisoft to prove it can deliver. Previous postponements — such as Shadows getting delayed from 2024 to 2025 — shook investors. Tencent’s power could also incite debate. Other fans on X are concerned about “spyware” or mobile-only games. There’s no hard evidence supporting those fears, but they are raging on the internet.

What’s Ahead for Both

This could be a win-win. €1.2 billion gives Ubisoft some breathing room. It can pay off debt (that’s down from €2.1 billion last year) and double down on hits. The spinoff could spit out quicker updates or free-to-play modes. For Tencent, it’s a passport to Western markets. China’s gaming cap at 180 million players, limits growth at home.

Next steps are clear. Ubisoft said more about its plans will be revealed soon, perhaps at its April earnings call. The subsidiary’s team will take up residence by summer. Tencent might advocate for mobile adaptations of Ubisoft’s intellectual property — a strength of its own. Analysts see growth if execution falls into place. “It’s a clever move,” said Joost van Dreunen, a gaming scholar at NYU.

The stakes are high in the long term. If it succeeds it might take Ubisoft ahead of the likes of EA. That kind of failure might bring more buyout talk. It’s another move toward global gaming dominance for Tencent. The deal is done. The real test begins now. Can Ubisoft turn those billions of dollars into classics? The world’s watching.