Disney and Reliance Close a Merger of Star India and Viacom18 Worth $8.5 Billion

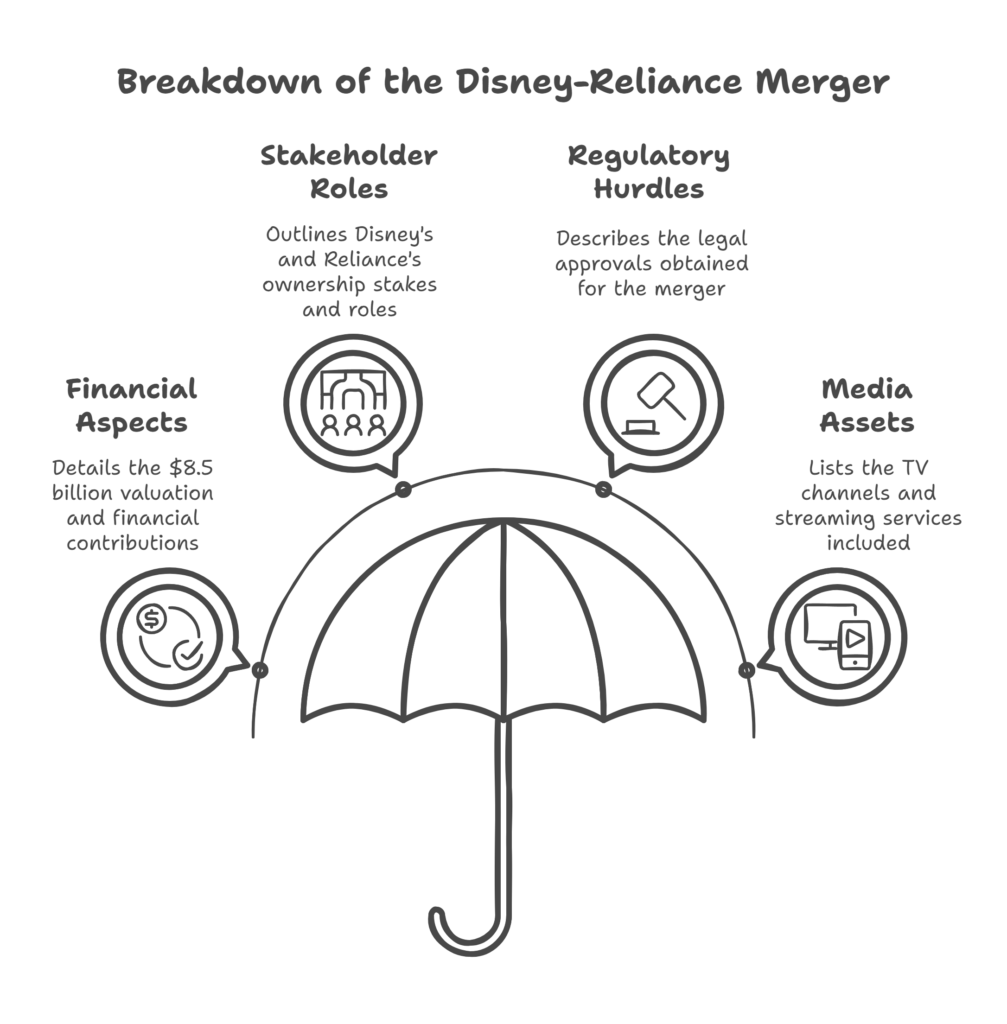

MUMBAI — It was November 14, 2024, when Disney and Reliance Industries confirmed an $8.5 billion merger of Star India and Viacom18, creating India’s largest media company.

The multibillion-dollar merged entity, announced in Mumbai on Friday, combines TV channels, streaming platforms and sports rights in a bid to penetrate the fast-growing Indian market.

A Mega Deal Takes Shape

The merger unites two giants. It has since emerged as an $8.5 billion joint venture between Disney’s Star India and Reliance’s Viacom18. It will also include over 120 TV channels and two streaming services — JioCinema and Hotstar. The taxpayer got $1.4 billion from Reliance to prime the pump. With a potential audience of more than 750 million in India and worldwide, the new company is knew.

With a direct 16.34% stake, and another 46.82% stake in future through Viacom18, Reliance hold the reins with 63.16% stake. Disney keeps 36.84%. The board of directors will be chaired by Nita Ambani, wife of Mukesh Ambani, chairman of Reliance. Uday Shankar — a media industry veteran — is appointed as the vice chairperson. The deal jumped hurdles such as India’s Competition Commission and the National Company Law Tribunal.

Why This Matters Now

The Indian media landscape is thriving, in fact. Streaming is rising, and cricket dominates TV. The merger solidifies some major winnings — rights to the Indian Premier League (IPL) and a few other top-tier sports. While Star India retained TV rights, Viacom18 won the digital IPL streaming rights in 2022. They have about 85 percent of India’s sports streaming market between them, according to Elara Capital.

A Tough Road to Victory

It wasn’t easy. Negotiations began in December 2023, hit roadblocks and were threatened by antitrust concerns. The Competition Commission were concerned that it could become a cricket monopoly but approved it in slightly altered form in August 2024. Disney’s Hotstar was also forced to shed users after Reliance streamed the IPL free on JioCinema. The merger allows Disney to remain strong in India, while also allowing its competitor, Reliance, to expand its digital clout.

Who’s Who in the New Setup

Three CEOs will run the show. Kevin Vaz for entertainment, Kiran Mani for digital, and Sanjog Gupta for sports. “This marks a new chapter for India’s media,” Uday Shankar said in a statement. The idea is to intermingle the hits from Star like StarPlus with Viacom18’s Colors and sprinkle in global gems from Disney — Marvel and HBO, for instance.

Background Fuels the Buzz

Disney previously valued its India arm at $15 billion following its 2019 acquisition of Fox. But losses mounted — Hotstar lost millions and cricket rights cost billions. The rumble was brief, but India’s top private company saw an opportunity. It won the bidding for IPL live streaming away from Disney, and it poached HBO from Hotstar. This deal turns that on its head, combining their strengths.

Reliance provides cash and local expertise. Last year its revenue topped $119.9 billion. Disney also adds a trove — more than 30,000 content assets. The revenue of the joint venture for 2024 was $3.1 billion, according to early reports. It’s also entering India’s crowded race to take on Netflix, Amazon and Sony.

What Lies Ahead for Media in India?

This could change the game. The new combine could raise ad prices because of its massive reach. Viewers gain more options — ranging from Bollywood to cricket — all under one roof. But critics fret about reduced competition. Will prices rise? Will smaller players survive? That might not surprise analysts who predict a 15% market boost by 2027.

The merger’s complete, but the work’s just begun. JioStar. com, the new digital hub, suggests grand ambitions. It may take months to integrate Hotstar and JioCinema. The smooth tech and happy users are key to success. For the moment, Disney and Reliance are placing their big bets on 1.4 billion people in India.