Parliament Discusses Waqf Bill, and Cuts to GST

NEW DELHI — India's Parliament plumbed its way through Waqf (Amendment) Bill, 2024; and GST rate cuts on March 10, 2025, in the capital. Lawmakers convened to discuss property management for Muslim charities and to simplify taxes on everyday items. The two-pronged attention is intended to increase fairness, transparency and economic relief as costs have gotten more expensive.

Waqf Bill Sparks Debate

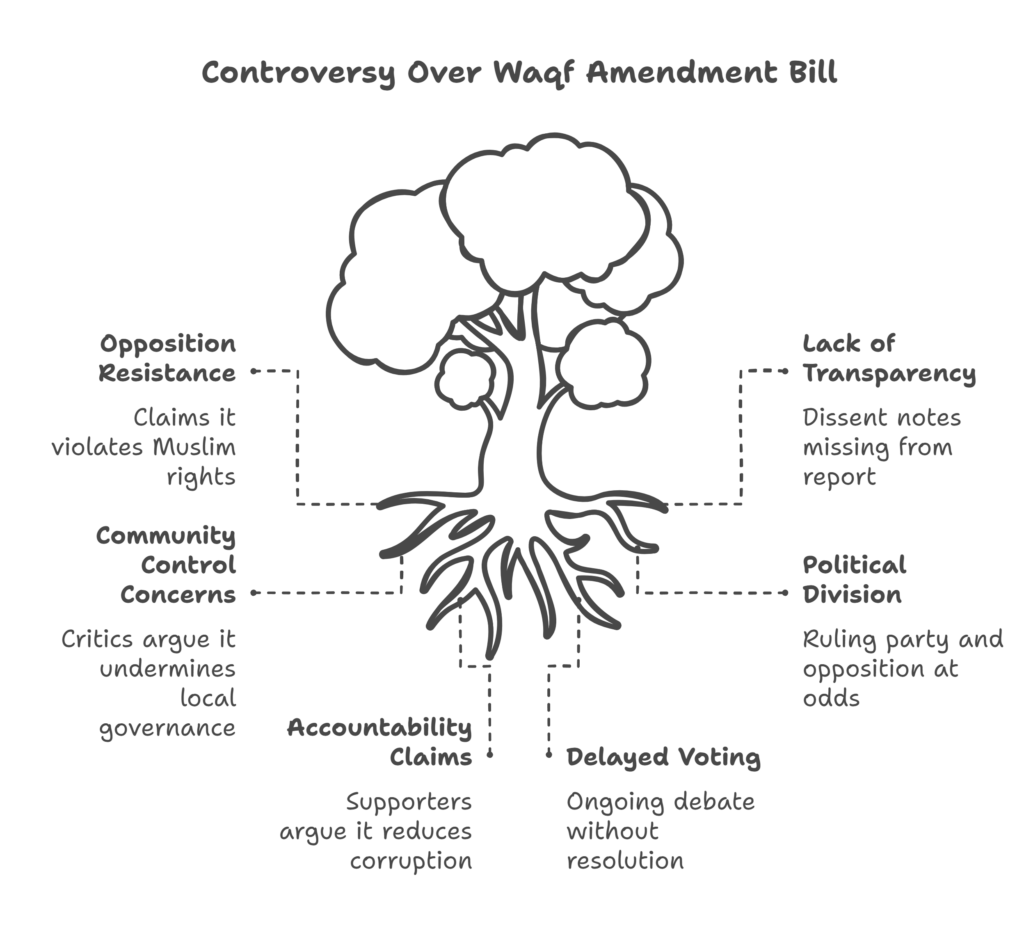

The Lok Sabha erupted over The Waqf (Amendment) Bill. It aims to reform the management of Waqf properties — land and buildings donated for religious or charitable purposes. The bill was introduced last August but faced pushback from opposition parties. It interferes with Muslim rights, they say. The ruling Bharatiya Janata Party (BJP) says it brings clarity and accountability. The JPC submitted its report in February, after concluding months of review. It retained 14 changes made by its own allies in the BJP but threw out all 44 suggestions made by the opposition.

Opposition MPs stormed out in a shouting match. The dissent notes they wrote up disappeared from the report, they said. The Congress leader Mallikarjun Kharge described it as “anti-democratic.” Union Minister Kiren Rijiju countered, “No deletions happened — everything is on the table.” The bill allows non-Muslims to sit on Waqf boards, and gives officers authority to resolve property disputes. Allies argue it reduces corruption. Critics say it undermines community control. The debate continued, and no vote had yet been scheduled.

GST Cuts Steal the Spotlight

Finance Minister Nirmala Sitharaman pitched the reduction in GST rates at the same time. Mister GST — hot from the 55th meeting of the GST Council in December 2024 — turned its gaze towards lower taxes on household items. Rates were already down from 15.8% in 2017 to 11.4% now. Goods like refrigerators and cement that are stuck at 28% could get some relief soon. The goal? Soften inflation and ignite spending before the holiday crush. The move is cheered by businesses, which are hoping for similar rules.

GST was launched in 2017 to simplify India’s tax mess. It consolidated layers of both state and central levies into one system. But five slabs — 0%, 5%, 12%, 18% and 28% — left many bewildered. The smaller firms lagged behind. Consumers complained about high rates on essentials. Latest adjustments reduced taxes on cancer drugs (to 12% from 5%) and snacks (to 18% from 12%). Now, lawmakers want more. Others advocate only one or two slabs. States, however, are concerned about losing money if cuts go too deep.

Balancing Act in Play

The timing aligns with India’s ambitious economic plans. With growth humming, the government seeks to woo investors and aid families. A slimmed-down GST could ease the path of business. But the changes regarding Waqf award the government the power to resolve dues of historical property: India has 8.7 lakh Waqf properties and many are either mired in litigation or under chisel and hammer. Collectively, these would boost confidence in the system. But both face hurdles. Easy but not enough: GSTs revenue (States need convincing) The Waqf Bill could ignite even more protests if communities feel marginalized.

Sitharaman and mentioned during a GST Council meeting in late March. “We’re near important decisions about rates,” she said at an event in Mumbai last week. That would enshrine cuts by April. For the Waqf Bill, the term of the JPC lasts until the conclusion of Budget Session in April 2025. Further discussions with stakeholders — state Waqf boards, for example — are expected. Both are tests for Parliament’s ability to reach compromises in a raucous democracy.

What’s Ahead for India?

These debates hold the key to India’s future. Hit to GST may cool prices and enhance buying power. An efficient Waqif system could also release land for public use. But risks loom. Frantic tax changes could squeeze state budgets. If faith is compromised, the Waqf Bill may lead to riots. What Parliament does next will reveal whether relief or gridlock prevails. For now, citizens watch with bated breath—hoping for action, not just argument. The session resumes March 11, and watch for deals, votes.