Nestle India Shines Bright in Tough Times

MUMBAI — Nestle India’s stock stood tall on March 10, 2025, outpacing competitors as India’s market took a hit. The Nifty 50 dropped 1.5% amid global economic jitters, but Nestle India rose 2.3% at the BSE in Mumbai. Investors see it as a safe bet in a shaky economy.

A Rock in Rough Waters

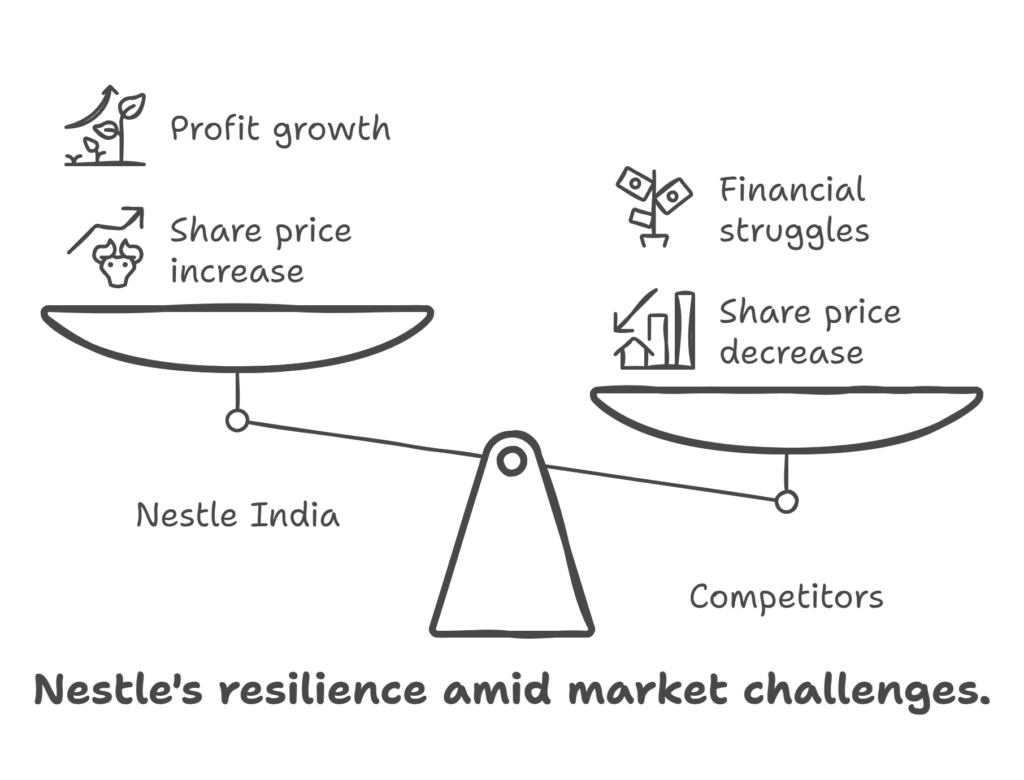

India’s stock market faced a tough day. The Sensex fell 1,200 points, and the Nifty FMCG index, which tracks food and consumer goods, slid 1.8%. Big names like Britannia Industries and Tata Consumer Products lost 2.5% and 3.1%, respectively. Yet, Nestle India bucked the trend. Its share price hit 2,250 rupees, up from 2,200 the day before. Why? Analysts point to its strong brands and steady demand.

Nestle India runs on trust. It sells everyday items like Maggi noodles, Nescafe coffee, and KitKat chocolates. These products stay popular, even when wallets tighten. The company’s market cap now sits at 217,000 crore rupees, showing its strength. While competitors struggle with rising costs and slow sales, Nestle keeps growing. Its latest quarterly report showed a 6% profit jump to 696 crore rupees for December 2024.

What Makes Nestle Special

Experts say Nestle India has a winning mix. It’s got a loyal customer base and smart planning. “Nestle’s focus on essentials gives it an edge,” said Priya Sharma, a market analyst at Mumbai-based Horizon Investments. “People don’t stop buying coffee or noodles in a downturn.” The company also invests big—7,500 crore rupees by 2025—to boost production and innovation.

Compare that to rivals. Britannia, known for biscuits, saw sales dip as urban demand weakened. Tata Consumer faced higher tea prices, squeezing profits. Nestle, though, keeps costs in check. It uses local suppliers and leans on its global parent, Nestle S.A., for tech support. That combo helps it dodge the worst of the market storm. Plus, its dividend payout of 86% keeps investors happy.

The broader market tells a grim tale. Foreign investors pulled out 24,753 crore rupees this month, per exchange data. That’s on top of 137,354 crore rupees yanked in 2025 so far. Inflation and a shaky U.S. dollar spooked traders. But Nestle India’s stock climbed anyway. Its three-year return stands at 23%, beating the Nifty 50’s 19%. That’s a sign of grit in a slump.

A Peek at the Numbers

Nestle India’s not new to winning. Over five years, its stock grew 49%, far ahead of peers like Britannia at 35%. The company’s revenue hit 24,275 crore rupees in FY24, up 10% from the year before. It’s not just luck—Nestle pushes hard into rural markets and adds new products fast. Think Maggi oats or Nescafe cold brew. These moves keep it ahead.

Competitors aren’t keeping up. Varun Beverages, a PepsiCo partner, dropped 2.7% today. Patanjali Foods fell 3.4% as herbal demand slowed. Nestle’s edge? It’s in every kitchen, urban or rural. The company added 5% more outlets last year, says Nielsen data. That reach pays off when others falter. Its cloud of stability draws investors seeking shelter.

Still, it’s not all smooth. Rising cocoa and coffee prices could pinch profits later. Urban slowdowns hit FMCG stocks hard—down 22% from September peaks. Nestle’s price-to-earnings ratio of 65 is steep, hinting it’s not cheap. But for now, it’s a bright spot. “Nestle India proves resilience matters,” Sharma added. Investors agree, betting on its steady climb.

Where It Goes From Here

This downturn tests every company. Nestle India’s next moves could cement its lead. It’s set to roll out more health-focused items—think low-sugar KitKats or protein-rich Maggi. That taps into growing wellness trends. If it keeps costs low and sales up, it might hit analyst targets of 2,659 rupees by year-end.

For investors, it’s a lifeline. The market may stay choppy with global cues unclear. But Nestle India’s track record suggests it can weather the storm. Rivals might catch up if demand rebounds, but Nestle’s head start is clear. Its rural push and brand power could fuel more gains. The big question: Can it keep shining as costs rise? Time will tell, but today, it’s the stock to watch.