Reliance Infra Shares Soar: More Gains Ahead?

MUMBAI, India — Reliance Infrastructure Ltd. shares surged 20% over three days, ending Friday, March 7, 2025, on the Bombay Stock Exchange (BSE). The rally started Tuesday as investors cheered the company’s debt cuts and new defense deals. This spike has many asking: Can the stock keep climbing?

A Fast Climb Sparks Buzz

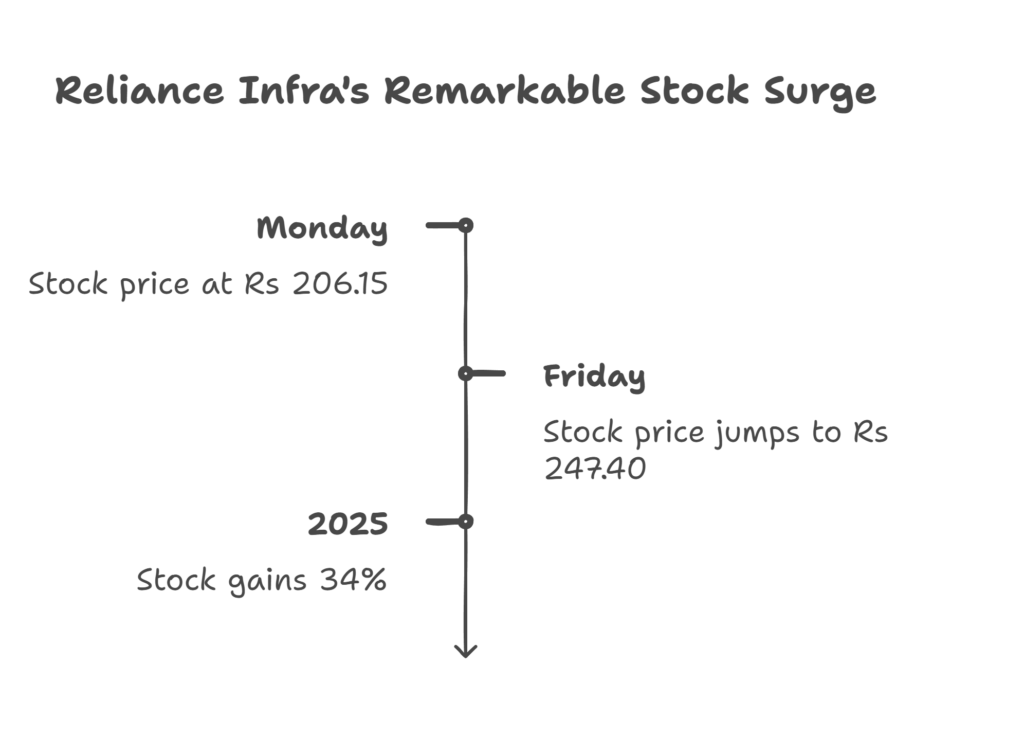

The stock hit Rs 247.40 on Friday, up from Rs 206.15 on Monday. That’s a 20.07% jump in just three sessions. Trading volume spiked too, with 4.70 lakh shares swapped Friday, beating the two-week average of 3.87 lakh. The company, led by Anil Ambani, has been in the spotlight after slashing its standalone debt from Rs 3,831 crore to Rs 475 crore. News of a Rs 10,000 crore defense project in Maharashtra added fuel to the rise.

Reliance Infra’s market value now sits at Rs 9,530.92 crore. The stock has gained 34% in 2025 so far, bouncing back from a tough 2024. Last year, it faced setbacks like a Supreme Court ruling reversal and a SEBI ban on Ambani. Yet, this week’s surge shows investors are betting on a turnaround.

Debt Cuts Lift Spirits

The company’s debt reduction is a big driver. Reliance Infra cleared dues to lenders like ICICI Bank and Edelweiss Asset Reconstruction. “This move strengthens their balance sheet,” said Rakesh Patel, a market analyst at Mumbai-based Horizon Investments. “Investors see less risk now.” The firm also settled a corporate guarantee for Reliance Power, wiping out more obligations.

On top of that, a new defense deal has people talking. The Maharashtra project, announced last month, could bring steady cash flow. Reliance Infra’s focus on infrastructure and defense fits India’s push for homegrown industries. Still, the stock’s 52-week high is Rs 351, so it’s got room to grow — or fall.

Can It Keep Going?

Analysts are split on what’s next. The stock’s 14-day relative strength index (RSI) hit 68.32 Friday. That’s close to 70, a level some call “overbought.” If it crosses that line, selling could kick in. Support sits at Rs 230, with resistance at Rs 250. A break above Rs 250 might push it to Rs 290, experts say.

Market trends play a role too. India’s Nifty 50 index has been choppy in 2025, with foreign investors pulling out Rs 1,13,721 crore by late February. But Reliance Infra’s gains buck that trend. Its defense and infra focus could shield it from broader market dips. Plus, rumors of a stake sale to a global firm like Nippon Life Insurance keep hope alive.

Risks and Rewards Ahead

Not everyone’s sold on the rally. Last year, the stock crashed 36% in two days after a court loss tied to a Delhi Metro dispute. SEBI’s five-year ban on Ambani, starting August 2024, still looms. These hiccups remind investors of the risks. Yet, the debt cleanup and new projects signal a fresh start.

“The stock has momentum, but it’s not risk-free,” Patel added. “Watch earnings and project updates.” The next earnings report, due March 31, could sway the mood. If profits climb or the defense deal firms up, more gains might follow. For now, traders are eyeing Rs 250 as the line to watch.

What’s the Next Step?

Reliance Infra’s 20% leap has grabbed attention. It’s a rare bright spot for the Anil Ambani-led firm after years of struggles. The debt drop and defense push give it a shot at recovery. But hurdles like market swings and past baggage could trip it up.

Investors face a choice: ride the wave or wait for proof. Breaking Rs 250 could spark more buying. A dip below Rs 230 might cool things off. Either way, the stock’s fate hinges on execution. If Reliance Infra delivers on its promises, this rally might just be the start. Keep an eye on Mumbai — and that earnings call.