IndusInd Bank Shares Drop: A Simple Look

MUMBAI, India — IndusInd Bank shares slipped 4% on Friday, March 7, 2025, landing close to their lowest point in 52 weeks. The drop happened on the Bombay Stock Exchange (BSE) as investors worried about the bank’s leadership and financial health. This decline reflects growing concerns after recent news about its management and earnings.

A Tough Week for IndusInd

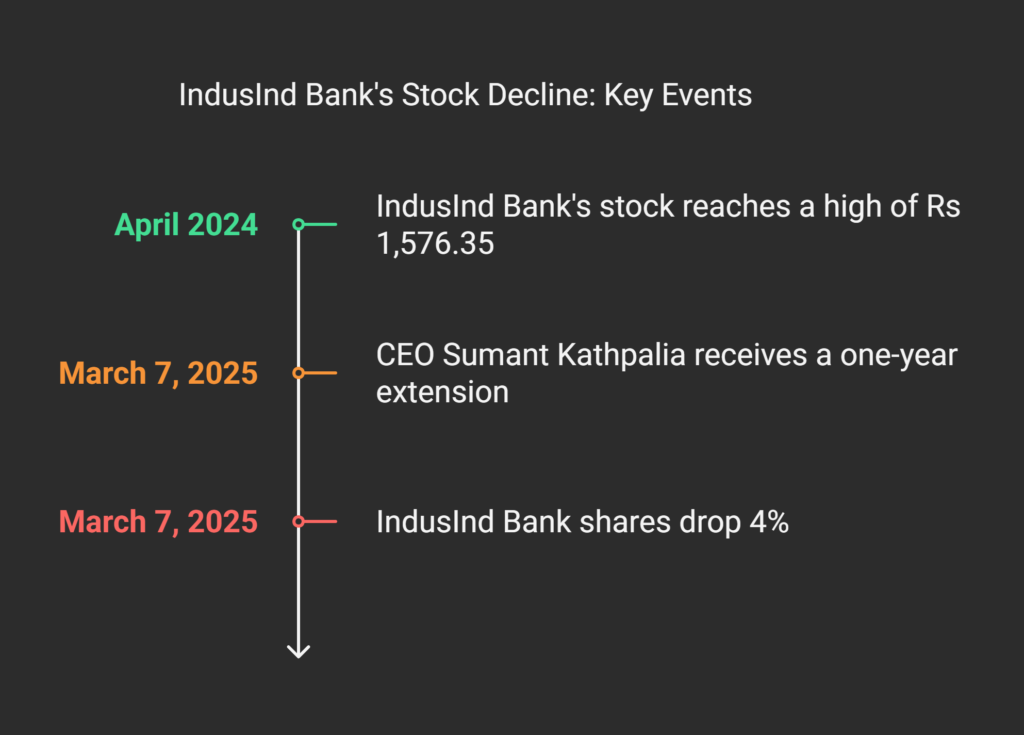

The bank’s stock closed at Rs 936.80, down 3.53% from the day before. This marks three days in a row of losses. The price is now near its 52-week low of Rs 923.40, a sharp fall from its high of Rs 1,576.35 last April. Investors sold off shares after the Reserve Bank of India (RBI) gave CEO Sumant Kathpalia just a one-year extension. That news, paired with a key executive’s exit, sparked doubts about the bank’s future.

Analysts say the bank has struggled lately. Its microfinance loans — a big part of its business — are seeing more defaults. Plus, the bank’s net profit dropped 40% in the September 2024 quarter to Rs 1,331 crore. This mix of issues has dragged the stock down 35% over the past year, while the broader BSE Sensex only fell 0.91%.

Leadership Woes Add Pressure

The RBI’s decision to limit Kathpalia’s term to one year raised eyebrows. Normally, bank CEOs get longer extensions. Experts see this as a sign the regulator wants tighter control. At the same time, the bank’s chief financial officer left, adding to the uncertainty. “The short tenure and staff changes signal trouble,” said Priya Sharma, a banking analyst at Mumbai-based Horizon Research. “Investors don’t like this kind of instability.”

On top of that, a bulk sale of shares shook things up. Integrated Core Strategies, an Asia-based firm, sold over 5 million shares at Rs 986.74 each on March 2. This move cut the stock’s value further. Foreign investors have also pulled back, with their stake dropping from 55.53% to 46.63% by December 2024. That shift could mean more selling ahead.

Financial Struggles in Focus

IndusInd Bank’s troubles go beyond management. Its microfinance arm, which makes up 35% of its loans, is under stress. Defaults in this area jumped 74% last quarter, hitting Rs 2,432 crore. The bank also saw its net interest income dip to Rs 5,228 crore from Rs 5,296 crore a year ago. These numbers show why the stock keeps sliding.

Market watchers point to broader trends too. India’s stock market has been shaky in 2025. Foreign investors have yanked Rs 1,13,721 crore from Indian shares this year, per NSDL data. IndusInd isn’t alone in facing pressure, but its specific problems make it stand out. The Nifty Bank index, which includes IndusInd, fell over 500 points on January 10, showing sector-wide jitters.

What’s Next for IndusInd?

The bank’s next steps could shape its fate. Analysts expect more clarity when IndusInd releases its latest earnings on March 31, 2025. If defaults keep rising or profits stay weak, the stock might dip below Rs 900 — a key support level. On the flip side, a rumored stake sale to Nippon Life Insurance could lift spirits. Bloomberg reported the Japanese firm might buy a small share, though no deal is set.

For now, the mood is cautious. UBS, a global brokerage, downgraded IndusInd to “sell” on March 9, cutting its target price to Rs 850. That’s a 9% drop from Friday’s close. Sharma from Horizon Research agrees the bank needs a clear plan. “They must fix the microfinance mess and steady their leadership,” she said. Without that, more rough days could lie ahead.

Investors are watching closely. The bank’s market value sits at Rs 74,750.18 crore, a big drop from its peak. If IndusInd can’t turn things around, it risks losing more ground in India’s crowded banking scene. The coming weeks will show if it can bounce back or sink lower.